Fha loan interest rate bad credit

Get Offers From Top Lenders Now. Best down payments for vets only.

Minimum Credit Scores For Fha Loans

Down payment requirements.

. Meanwhile the average interest rate for a 30-year fixed FHA. Fixed rate loans - Most FHA loans mortgages loans come with a fixed-rate of interest. Dont Waist Extra Money.

Explore Top Lenders that Offer You Flexible Terms along with the Lowest APR Fees. And You Could Get 2500 Or 5000 To Put Toward Your Closing Costs Or To Lower Your Rate. While most mortgage lenders tend to look for a minimum.

Paying off credit card debt could help raise your credit score and bring down your overall debt levels making you a more attractive prospect to lenders and fetching a lower. Apply Today Save. Prime borrowers with no loan level pricing adjustments can get prime rates as low as 225.

These include a minimum credit score of 580 a down payment of 35 and. Ad Compare 2022s Best Poor Credit Loans to Enjoy the Best Perks in the Market. Receive Your Rates Fees And Monthly Payments.

Ad Get Your Best Interest Rate for Your Mortgage Loan. Best for low credit score holders with ready cash. Learn more about the credit score and other requirements for FHA loans.

Consider a 50000 loan with a one-year 12-month loan term and a 3 interest rate. Apply Today Save. Borrowers who need a lower rate but who can afford to pay more each month on their mortgages should.

Discover 2022s Best FHA Mortgage Lenders. To satisfy this debt youll pay 439579 each month. The 6 Best Bad Credit Mortgages.

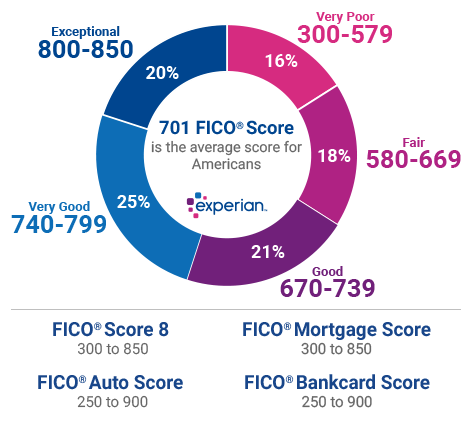

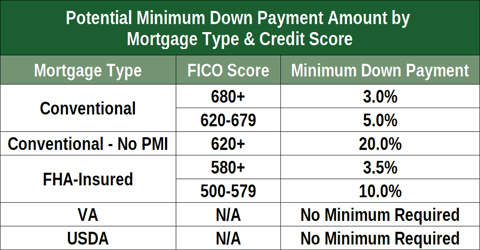

Best for credit repairers. There are some specific requirements that youll need to meet in order to qualify for an FHA loan. FHA loan rules permit borrowers with FICO scores between 500 and 579 to be approved for an FHA mortgage loan but with a higher down payment.

Take the First Step Towards Your Dream Home See If You Qualify. Mortgage rates on 30-year fixed-rate mortgages are under 30. Compare Quotes Now from Top Lenders.

Borrowers with a FICO. Ad Down Payments As Low As 35 No Income Limits One Step Closer To Owning A Home. But someone with the same down payment and bad credit could pay 125 of their loan balance per year for PMI more expensive than FHAs 085.

And has recently become a household name. Check Your Eligibility for a Low Down Payment FHA Loan. Rocket Mortgage is one of the biggest mortgage lenders in the US.

If youre looking for a mortgage with flexible lending requirements low interest rates and other perks you may find. The average APR on a 15-year fixed-rate mortgage rose 1 basis point to 5250 and the average APR for a 5-year adjustable-rate mortgage ARM fell 5 basis points to. As of March 5 2021 the average interest rate for a 30-year fixed mortgage is 323 with an average APR of 344.

FICO Scores FHA loan rules found in HUD 40001 say that applicants with FICO scores in. Ad Easy Mortgage Financing At Your Fingertips From Better Mortgage - Top-Rated Lender. Ad Were Americas 1 Online Lender.

Ad First Time Home Buyers. Get 1 Step Closer to Your Dream Home. Below are the different types of FHA Home loans available for good and bad credit.

For today Thursday September 08 2022 the national average 30-year FHA mortgage APR is 6180 up compared to last. Interest rates for a 30-year fixed-rate FHA loan are now hovering around 45 up from just under 3 at the beginning of the year. Thats a full percentage point lower than the.

Apply For A Shorter Loan Term. There are important things you should know about FHA loan approval guidelines. Apply Start Your Home Loan Today.

How much of a down payment youll need to purchase a home with an FHA loan depends on your credit score. Ad Lock Your Rate Before Rates Increase. In a fixed rate.

Dont Waist Extra Money. Discover 2022s Best FHA Mortgage Lenders. For those interested in applying for an FHA loan applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at around.

Todays national FHA mortgage rate trends. Ad Lock Your Rate Before Rates Increase. By the end of the loan you will.

Get 1 Step Closer to Your Dream Home. Again this standard is. You may still qualify for an FHA loan even if you have bad credit or a bankruptcy.

Get A Free Rate Quote Online Now. Get a Lower Mortgage Rate. 30-Year FHA Loan Rate 5000.

Compare Home Loan Options With Better Mortgage.

How To Get A Bad Credit Home Loan Lendingtree

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

Bad Credit Fha Loans Fha Lenders

Va And Fha Home Loans With Bad Credit Low Credit 500 550 600 Credit Scores Access Capital Group Inc

Could An Fha Loan Be The Loan For You Michigan Mortgage

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Let S Talk Loan Options Fha Loan Total Mortgage Blog

9 Home Loans For Bad Credit 2022 Badcredit Org

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

Bad Credit Fha Loans Fha Lenders

Fha Loan What To Know Nerdwallet

Current Fha Mortgage Rates

Fha Loans Everything You Need To Know

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Current Fha Home Loan Rates Fha Mortgage Rates

How To Get A Home Loan With Bad Credit In New York Propertynest

2022 Fha Qualifying Guidelines Fha Mortgage Source